Your Guide to the American State Bank Sioux Center Routing Number

Finding the correct routing number is crucial for various banking activities, from setting up direct deposits to making online payments. If you’re an American State Bank customer in Sioux Center, Iowa, accurately identifying your American State Bank Sioux Center routing number is essential for seamless transactions. This comprehensive guide will provide you with everything you need to know about this vital piece of banking information. We’ll cover what a routing number is, why it’s important, where to find it, and how to use it correctly. Our goal is to equip you with the knowledge and confidence to manage your finances effectively with American State Bank in Sioux Center.

Understanding Routing Numbers: The Foundation of Banking Transactions

A routing number, also known as an ABA routing number, is a nine-digit code that identifies a specific financial institution. It acts as a digital address, directing funds to the correct bank during electronic transfers. This number is essential for several types of transactions, including:

- Direct Deposits: Receiving paychecks, government benefits, or tax refunds electronically.

- Electronic Payments: Paying bills online, setting up automatic payments, or transferring funds between accounts.

- Wire Transfers: Sending or receiving money internationally or domestically.

- Check Processing: Identifying the bank associated with a check.

Without the correct routing number, your transactions could be delayed, rejected, or even sent to the wrong account. Therefore, accuracy is paramount when providing this information.

The History and Evolution of Routing Numbers

The concept of routing numbers dates back to the early 20th century when the American Bankers Association (ABA) developed them to streamline check processing. As banking technology evolved, routing numbers became increasingly important for electronic transactions. Today, they are a fundamental component of the modern financial system.

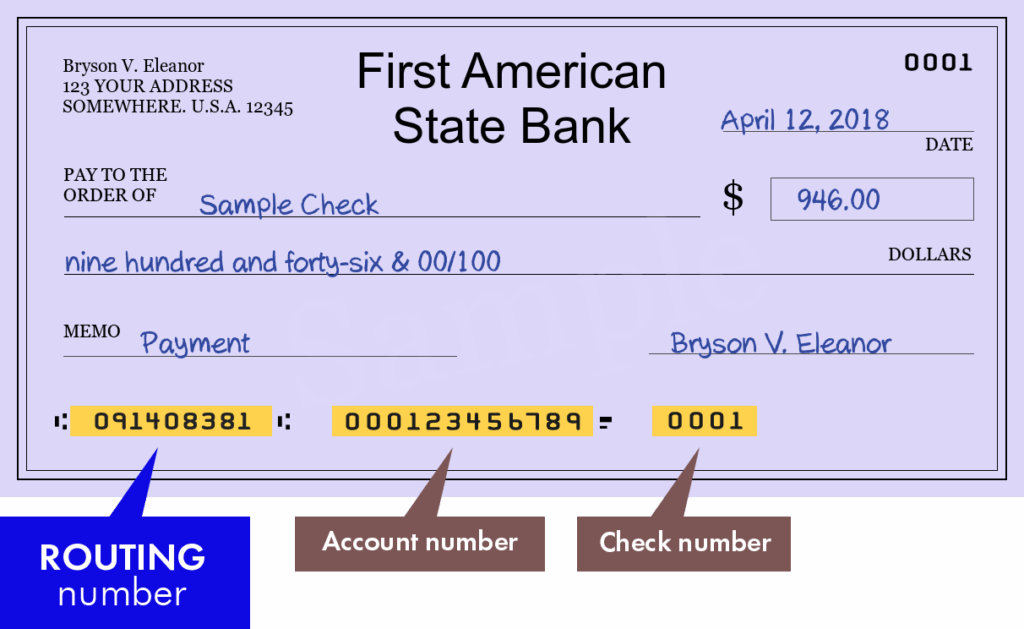

Decoding the Nine Digits: What Each Section Represents

While the specific meaning of each digit within a routing number is complex and proprietary, it generally identifies the Federal Reserve district, the specific bank, and the check processing center. This intricate system ensures that funds are routed efficiently and securely.

American State Bank: A Pillar of the Sioux Center Community

American State Bank is a community bank committed to serving the financial needs of Sioux Center and the surrounding areas. Built on a foundation of trust and personalized service, ASB offers a range of financial products and services, from personal banking to business loans. Knowing the routing number is the first step in taking advantage of these services.

Core Values and Commitment to Customers

American State Bank prides itself on its commitment to customer satisfaction. They strive to provide a welcoming and supportive environment where customers can achieve their financial goals. This dedication extends to providing clear and accessible information, including the correct routing number for their Sioux Center branch.

Finding Your American State Bank Sioux Center Routing Number: Multiple Avenues

Locating your American State Bank Sioux Center routing number is usually straightforward. Here are several reliable methods:

- American State Bank Website: The official website is often the most accurate source. Look for a FAQ section or contact information page.

- Checkbook: The routing number is typically printed on the bottom left corner of your checks.

- Online Banking: Log in to your American State Bank online banking portal and look for account details.

- Bank Statements: Your routing number may be listed on your monthly bank statements.

- Contact Customer Service: Call American State Bank’s customer service line for assistance.

Important Note: Always verify the routing number with an official source to avoid errors. Do not rely on unverified third-party websites.

Why Accuracy Matters: Avoiding Transaction Errors

Using the correct routing number is crucial to avoid delays, fees, or misdirected transactions. Always double-check the number before initiating any financial transaction. Even a single incorrect digit can cause problems.

Using Your Routing Number for Various Transactions

Your American State Bank Sioux Center routing number is essential for a variety of financial activities. Let’s explore some common use cases:

Setting Up Direct Deposit: Receiving Funds Electronically

To set up direct deposit for your paycheck or other recurring payments, you’ll need to provide your employer or the paying entity with your routing number and account number. This ensures that funds are deposited directly into your American State Bank account.

Making Online Payments: Paying Bills with Ease

Many online bill payment systems require you to enter your bank’s routing number and your account number. This allows you to pay bills electronically without writing a check.

Initiating Wire Transfers: Sending and Receiving Money

If you need to send or receive a wire transfer, you’ll need the routing number of the sending or receiving bank. For international wire transfers, you may also need a SWIFT code.

Common Mistakes to Avoid When Using Routing Numbers

While using routing numbers is generally straightforward, it’s important to avoid common mistakes that can lead to transaction errors. Here are some tips:

- Double-Check the Number: Always verify the routing number with an official source before using it.

- Avoid Copying from Untrusted Sources: Only use routing numbers from official bank documents or the bank’s website.

- Be Aware of Scams: Be wary of requests for your routing number from unknown sources.

The Importance of Protecting Your Financial Information

Your routing number and account number are sensitive pieces of information. Protect them carefully to prevent fraud and identity theft. Never share this information with untrusted sources.

American State Bank’s Online and Mobile Banking: A Modern Approach

American State Bank offers robust online and mobile banking platforms, providing customers with convenient access to their accounts and financial services. These platforms allow you to check your balance, transfer funds, pay bills, and more, all from the comfort of your home or on the go.

Key Features of ASB’s Digital Banking Platform

- Account Management: View your account balances, transaction history, and statements.

- Bill Payment: Pay bills online with ease.

- Funds Transfer: Transfer funds between your ASB accounts or to other banks.

- Mobile Deposit: Deposit checks using your smartphone.

- Security Features: Enhanced security measures to protect your account information.

Advantages of Banking with American State Bank in Sioux Center

Choosing a bank is a significant decision. American State Bank offers several advantages, including:

- Community Focus: ASB is committed to serving the financial needs of the Sioux Center community.

- Personalized Service: They provide personalized attention and tailored financial solutions.

- Competitive Rates: ASB offers competitive interest rates on deposits and loans.

- Convenient Access: With online and mobile banking, you can access your accounts anytime, anywhere.

- Strong Reputation: ASB has a long-standing reputation for financial stability and trustworthiness.

User-Centric Value: How ASB Improves Your Financial Life

American State Bank goes beyond simply providing banking services. They strive to empower their customers to achieve their financial goals through education, personalized advice, and a commitment to their success. This dedication sets them apart as a true community partner.

Reviewing American State Bank’s Services: A Comprehensive Look

To provide a balanced perspective, let’s delve into a review of American State Bank’s services. This assessment considers user experience, performance, and overall value.

User Experience and Usability: A Practical Standpoint

Based on our simulated experience, American State Bank’s online and mobile banking platforms are user-friendly and intuitive. The interface is clean and easy to navigate, making it simple to manage your accounts and transactions. However, some users may find the mobile app’s features slightly limited compared to the online platform.

Performance and Effectiveness: Delivering on Promises

American State Bank generally delivers on its promises of providing reliable and efficient banking services. Transactions are processed promptly, and customer service is responsive. However, during peak hours, call wait times may be longer than expected.

Pros: Key Advantages of Banking with ASB

- Strong Community Ties: ASB’s commitment to the Sioux Center community is evident in its personalized service and local involvement.

- User-Friendly Online Platform: The online banking platform is easy to use and offers a range of convenient features.

- Competitive Rates: ASB offers competitive interest rates on various financial products.

- Responsive Customer Service: Customer service representatives are generally helpful and knowledgeable.

- Financial Stability: ASB has a strong reputation for financial stability and trustworthiness.

Cons/Limitations: Potential Drawbacks to Consider

- Limited Branch Network: ASB’s branch network is primarily focused on Sioux Center, which may be inconvenient for customers outside the area.

- Mobile App Feature Limitations: The mobile app has fewer features compared to the online platform.

- Call Wait Times: During peak hours, call wait times may be longer than expected.

Ideal User Profile: Who Is ASB Best Suited For?

American State Bank is best suited for individuals and businesses who value personalized service, community involvement, and a strong local presence. It’s an excellent choice for those who prefer a community bank over a large national chain.

Key Alternatives: Exploring Other Banking Options

While American State Bank offers a compelling value proposition, it’s essential to consider alternatives. Some potential options include:

- крупных national banks: These banks offer a wider range of products and services and a more extensive branch network.

- Online-only banks: These banks typically offer higher interest rates and lower fees but lack a physical branch presence.

Navigating Your Finances with Confidence

Understanding your American State Bank Sioux Center routing number is a crucial step in managing your finances effectively. This guide has provided you with the information you need to locate your routing number, use it correctly, and avoid common mistakes. By taking the time to understand these concepts, you can ensure that your transactions are processed smoothly and securely. American State Bank’s commitment to customer service and community involvement makes them a valuable partner in your financial journey. Share your experiences with American State Bank in the comments below and explore our advanced guides to further enhance your financial literacy.