Understanding CT Sales Tax on Cars: A Complete Guide for Connecticut Car Buyers

Buying a car in Connecticut involves more than just the sticker price. Understanding the Connecticut sales tax on cars is crucial for budgeting and avoiding surprises. This comprehensive guide provides everything you need to know about CT sales tax on car purchases, from calculating the tax to potential exemptions and navigating common scenarios. We aim to provide clarity and empower you with the knowledge to make informed decisions during your car buying journey. We draw upon years of experience assisting Connecticut residents with understanding vehicle-related financial obligations.

Decoding Connecticut’s Car Sales Tax: Rates, Calculations, and Key Considerations

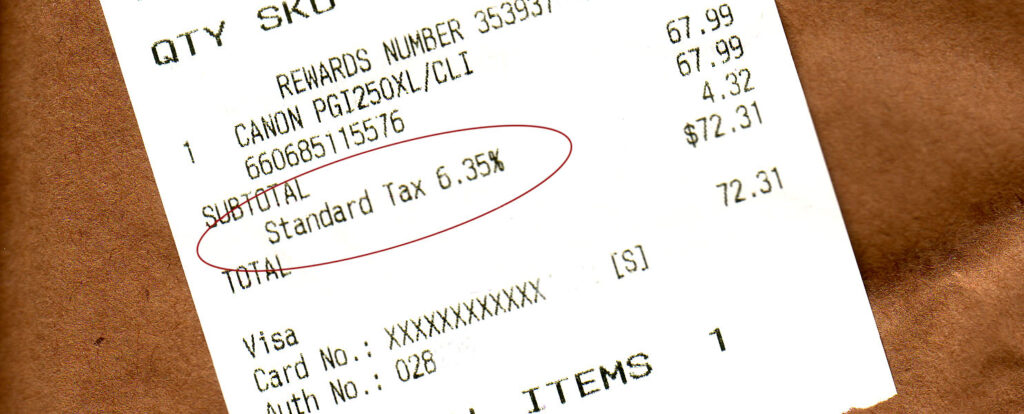

Connecticut imposes a sales tax on most goods and services, including vehicle sales. The standard sales tax rate in Connecticut is 6.35%. This rate applies to both new and used car purchases from dealerships and private sellers. However, it’s important to understand how this rate is applied and what factors can influence the final sales tax amount.

How the 6.35% Sales Tax Applies to Car Purchases

The 6.35% sales tax is calculated on the vehicle’s purchase price. This includes the base price of the car, any options or accessories added, and transportation or destination charges. The tax is applied before any trade-in credit or manufacturer rebates are deducted. This is a crucial point to remember when estimating your total cost.

Sales Tax on Leased Vehicles

Leasing a vehicle in Connecticut also incurs sales tax. However, the tax is applied differently than with a purchase. Instead of paying sales tax on the entire vehicle value upfront, you pay sales tax on each monthly lease payment. This can make leasing more manageable from a cash flow perspective, as you’re only taxed on the portion of the vehicle’s value you’re using each month.

Sales Tax on Out-of-State Purchases

If you purchase a vehicle from a dealership outside of Connecticut but intend to register and use it in Connecticut, you are still responsible for paying Connecticut sales tax. You will typically pay the sales tax to the Connecticut Department of Revenue Services when you register the vehicle. You may be able to receive a credit for sales tax paid to the other state, but this depends on the specific laws and reciprocity agreements between Connecticut and the state where you purchased the vehicle. Consulting with a tax professional is advisable in these situations.

Exemptions and Reductions: Saving Money on CT Car Sales Tax

While the 6.35% sales tax is generally applicable, certain exemptions and reductions may apply, potentially saving you a significant amount of money. It’s essential to explore these possibilities to determine if you qualify.

Trade-In Credit: Reducing the Taxable Amount

One of the most common ways to reduce the sales tax on a car purchase is through a trade-in. If you trade in your old vehicle when purchasing a new one, the value of your trade-in is deducted from the new car’s purchase price before the sales tax is calculated. For example, if you’re buying a car for $30,000 and trading in a vehicle valued at $10,000, you’ll only pay sales tax on $20,000. This can result in substantial savings. The trade-in must be with a licensed Connecticut dealer to qualify.

Exemptions for Certain Individuals and Organizations

Certain individuals and organizations are exempt from paying sales tax on vehicle purchases in Connecticut. These may include:

- Diplomats: Foreign diplomats stationed in Connecticut may be exempt from sales tax under certain international agreements.

- Non-profit organizations: Qualifying non-profit organizations may be exempt from sales tax on vehicles used for their charitable purposes.

- Disabled Veterans: Connecticut offers certain sales tax exemptions or reductions for disabled veterans. The specific requirements and benefits vary, so it’s important to check the current regulations.

Electric Vehicle (EV) Incentives and Sales Tax

Connecticut has been actively promoting the adoption of electric vehicles through various incentives. While there isn’t a direct sales tax exemption specifically for EVs, some EV incentives can effectively reduce the overall cost of the vehicle, thereby indirectly lowering the amount of sales tax you pay. These incentives may include rebates, tax credits, or other financial assistance programs. Always check the latest state and federal EV incentive programs to maximize your savings.

Navigating Private Car Sales: Sales Tax Responsibilities

Purchasing a car from a private seller in Connecticut also requires paying sales tax. However, the process is slightly different than buying from a dealership. The buyer is responsible for paying the sales tax directly to the Connecticut Department of Revenue Services when registering the vehicle.

Calculating Sales Tax on Private Car Sales

The sales tax on a private car sale is still calculated at the 6.35% rate. However, the taxable amount is typically the agreed-upon purchase price between the buyer and seller. It’s crucial to have a written bill of sale that clearly states the purchase price to avoid any disputes or issues when registering the vehicle.

Reporting and Paying Sales Tax on Private Sales

After purchasing a car from a private seller, you must report the sale and pay the sales tax to the Connecticut Department of Revenue Services. This is typically done when you register the vehicle at the Department of Motor Vehicles (DMV). You will need to provide the bill of sale, proof of insurance, and other required documents. The DMV will calculate the sales tax due and collect the payment.

Avoiding Sales Tax Evasion in Private Sales

It’s important to be honest and accurate when reporting the purchase price of a vehicle in a private sale. Underreporting the price to avoid paying the full sales tax is illegal and can result in penalties, fines, and even legal action. Both the buyer and seller can be held liable for sales tax evasion.

Common Scenarios and Specific Situations Regarding Car Sales Tax

The application of Connecticut sales tax on cars can vary depending on the specific circumstances. Here are some common scenarios and how sales tax applies in each case:

Gifting a Car: Is Sales Tax Applicable?

Generally, gifting a car to a family member or friend in Connecticut is not subject to sales tax. However, there may be certain requirements and documentation needed to prove that the transfer was a genuine gift and not a disguised sale. You may need to provide an affidavit or other supporting documents to the DMV.

Inheriting a Car: Sales Tax Implications

Inheriting a car as part of an estate is also typically not subject to sales tax in Connecticut. The transfer of ownership is considered a legal transfer rather than a sale. However, estate taxes may apply depending on the value of the estate.

Buying a Car for a Student Out of State

If you’re buying a car in Connecticut for a student who attends college out of state, the sales tax implications can be complex. If the student is a resident of another state and the car will be primarily used and registered in that state, you may be able to avoid Connecticut sales tax. However, you’ll need to provide proof of residency and registration in the other state. It’s best to consult with the Connecticut Department of Revenue Services or a tax professional to determine the specific requirements.

Expert Tips for Minimizing Your Car Sales Tax Burden

While you can’t avoid sales tax altogether, there are several strategies you can use to minimize your tax burden and save money on your car purchase:

- Maximize your trade-in value: Research the fair market value of your trade-in vehicle and negotiate the highest possible trade-in price.

- Time your purchase strategically: Dealerships often offer incentives and discounts at the end of the month or quarter to meet sales quotas. This can lower the purchase price and reduce the sales tax.

- Explore manufacturer rebates and incentives: Take advantage of any rebates or incentives offered by the manufacturer, as these can lower the purchase price.

- Consider leasing: Leasing can be a more tax-efficient option than buying, as you only pay sales tax on the monthly lease payments.

- Consult with a tax professional: A tax professional can provide personalized advice and help you identify any potential exemptions or deductions you may be eligible for.

Understanding the Broader Impact of Sales Tax in Connecticut

Sales tax is a crucial source of revenue for the state of Connecticut, funding essential public services such as education, infrastructure, and healthcare. Understanding how sales tax works and ensuring compliance helps support these vital services and contribute to the well-being of the community.

Revenue Allocation and Public Services

The revenue generated from sales tax is allocated to various state and local government programs. A significant portion goes towards funding public education, including primary, secondary, and higher education institutions. Sales tax revenue also supports infrastructure projects, such as road and bridge maintenance, and healthcare services, including Medicaid and other public health programs.

The Role of Sales Tax in Connecticut’s Economy

Sales tax plays a significant role in Connecticut’s overall economy. It affects consumer spending, business activity, and government revenue. Changes in the sales tax rate or exemptions can have a ripple effect throughout the economy. Monitoring sales tax trends and policies is essential for understanding the state’s economic health.

Key Takeaways for Connecticut Car Buyers

Navigating Connecticut sales tax on cars can seem complex, but understanding the rules and strategies outlined in this guide can empower you to make informed decisions and save money. Remember to factor in the 6.35% sales tax rate, explore potential exemptions and reductions, and be honest and accurate when reporting private sales. By taking these steps, you can ensure a smooth and cost-effective car buying experience in Connecticut.

We encourage you to share your own experiences with CT sales tax on cars in the comments below. Your insights can help other Connecticut car buyers navigate this process more effectively. If you’re seeking personalized guidance on your specific situation, contact our experts for a consultation. We’re here to help you make informed decisions and maximize your savings.